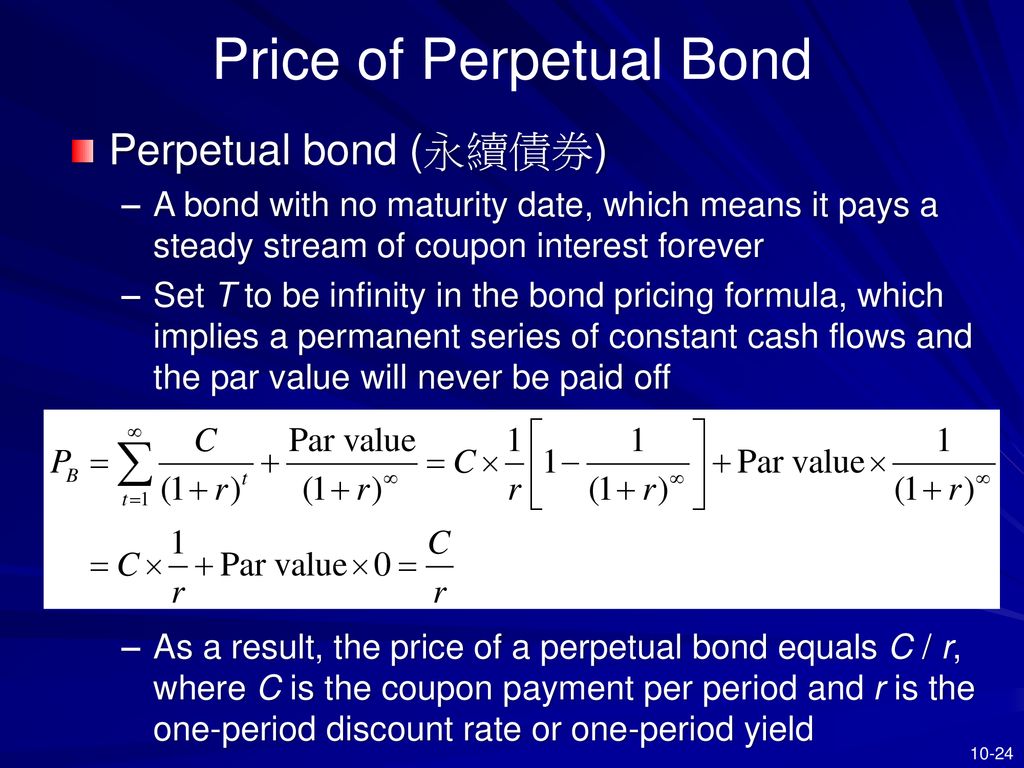

Perpetual bond formula

Assuming a 5 discount rate the. Perpetual bond refers to a bond without an expiration date.

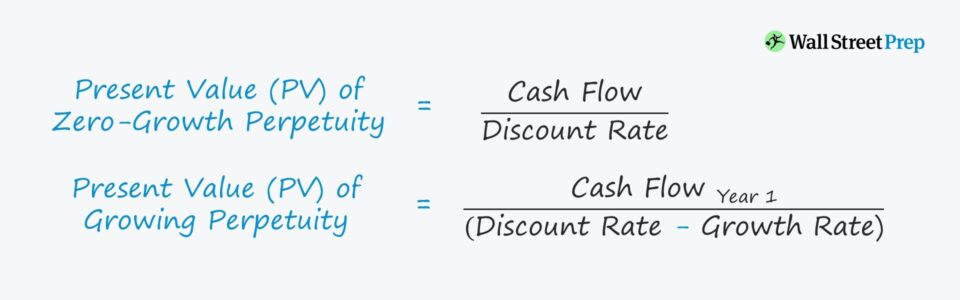

Perpetuity Formula And Financial Calculator Excel Template

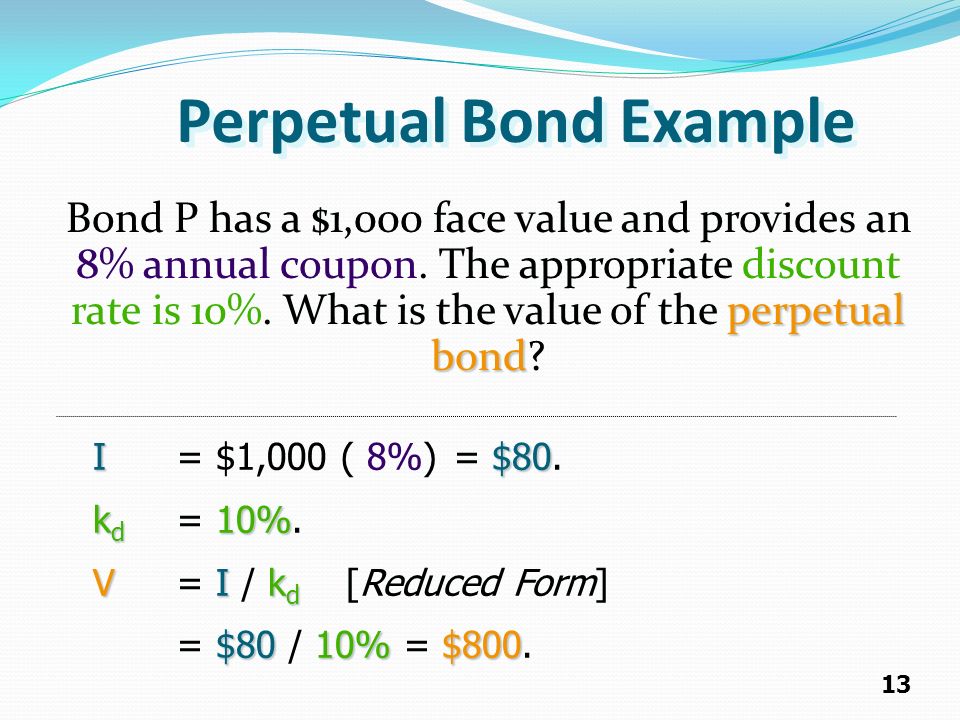

Example of the Perpetuity Yield Formula.

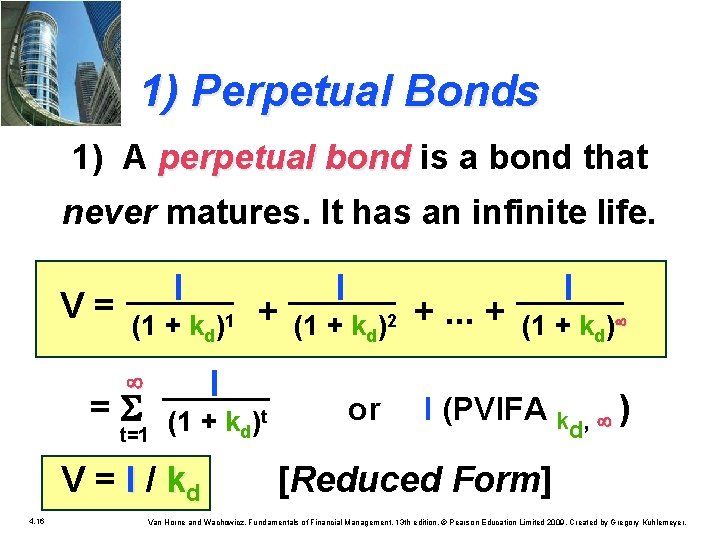

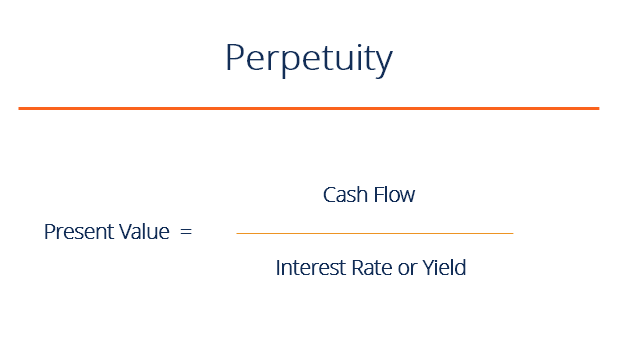

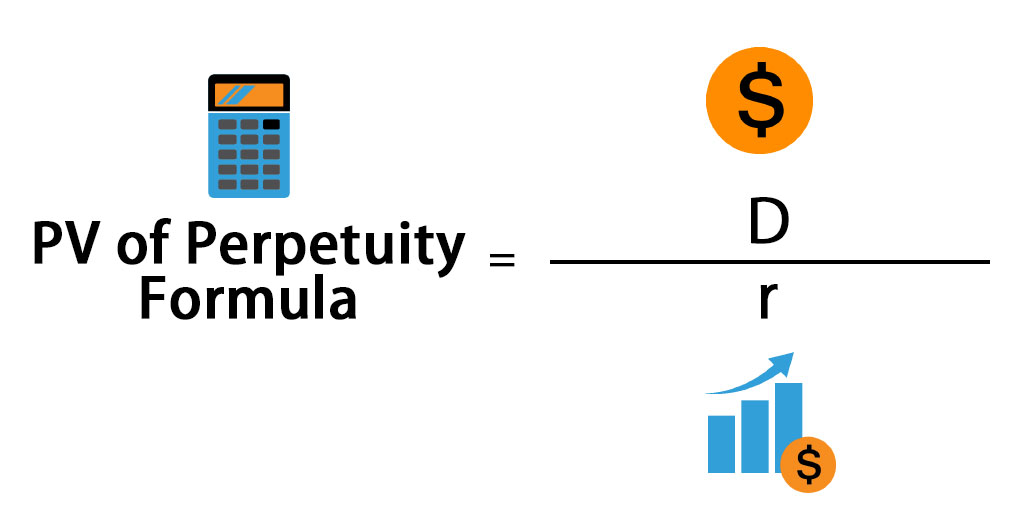

. Present Value Dr Where. Formula of Perpetual Bond The formula for calculating present value is D divided by r. Like conventional ones they issue coupons to investors to pay.

An example of the perpetuity yield formula would be. Hence mathematically its Present Value can be written as follows. D is the coupon payment or regular payment on the bond and r is the discount rate.

As such perpetual bonds even though they pay interest forever can be assigned a finite value which in turn represents their price. Formula for the Present Value of Perpetual Bond presently Dr And r is the bonds discount rate. Yield on a Perpetual Bond Formula.

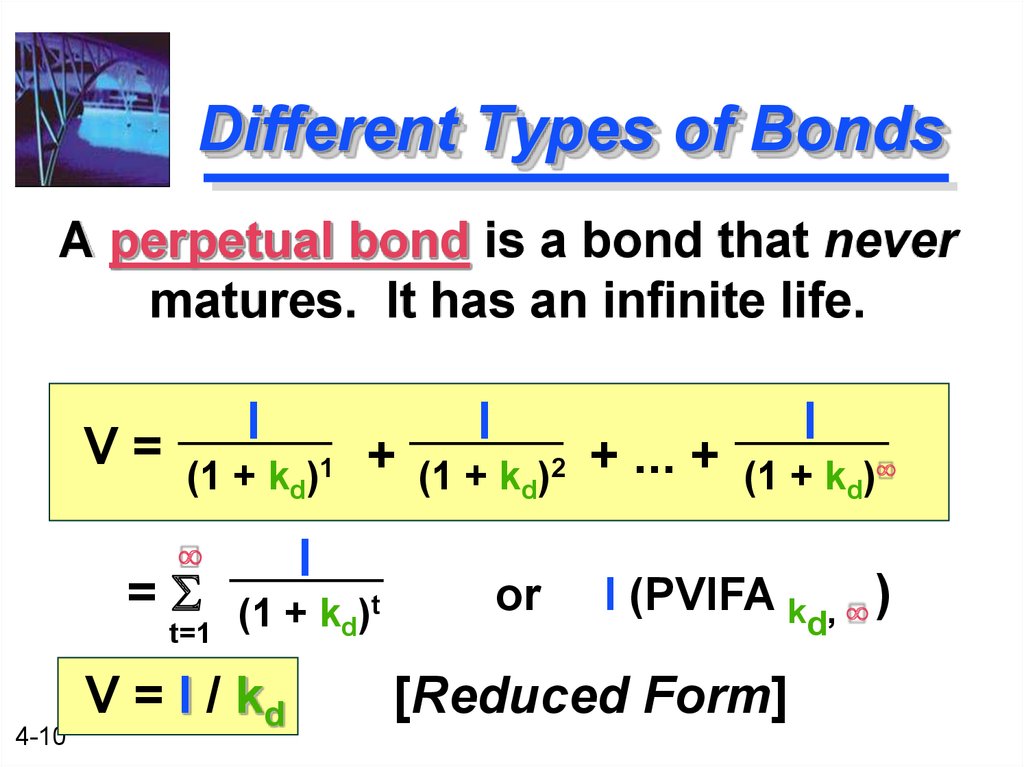

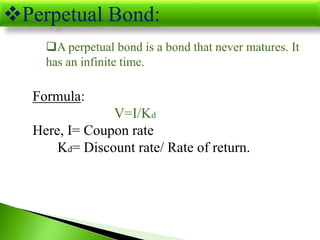

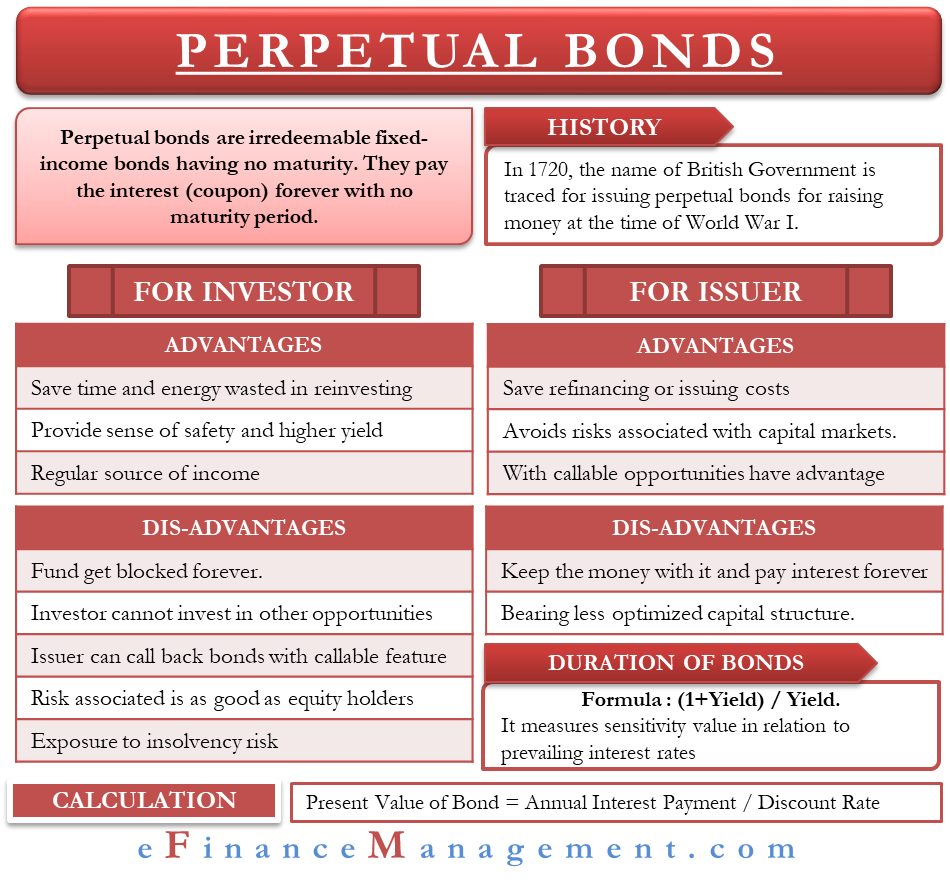

A perpetual bond also known colloquially as a perpetual or perp is a bond with no maturity date 1 therefore allowing it to be treated as equity not as debt. Bonds pricing and analysis Description Formula for the calculation of the price of a perpetual bond. Perpetual bonds sometimes perpetual perps or consol bonds are the types without an expirationmaturity date.

Formula for the calculation of the yield of a perpetual bond. Current Yield Annual Dollar Interest Paid Market Price X. The value of the perpetual bond is the discounted sum of the infinite series.

Hence it offers interest income to the instrument holder for. Perpetual Bond is an infinite series coupon paying bond. Formula P fracIr Legend I Nominal.

Price of a perpetual bond Tags. Additional information related to this. Below you will find descriptions and details for the 1 formula that is used to compute yields for perpetual bonds.

The discount rate depends upon. The formula for calculation of value of such bonds is. Where I is the annual.

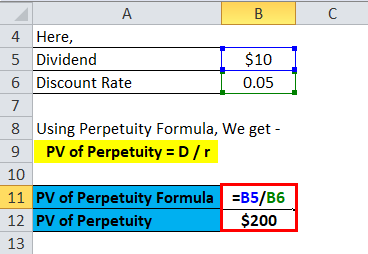

PVA A 1K-1 A 1K-2A 1K-1 A. However the rate may change over time which will affect the value of the perpetual investment. Example of Perpetuity Value Formula An individual is offered a bond that pays coupon payments of 10 per year and continues for an infinite amount of time.

Formula r fracIP Legend I Nominal coupon rate P Bond clean price. Issuers pay coupons on perpetual. It is a fixed income financial instrument with no maturity date.

I Required rate of return. Formula for the Present Value of a. Investors can calculate how much return they will earn from a perpetual bond by using the following formula.

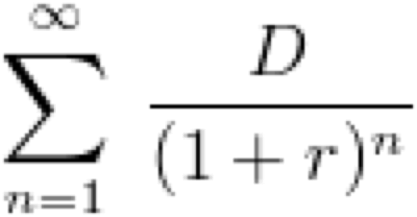

PV Present Value D Dividend or Coupon payment or Cash inflow per period and r Discount rate Alternatively we can also use the following formula PV of Perpetuity n1 D 1rn. If a perpetual bond pays 10000 per year and the discount rate is 4 the. D annual coupon payment r coupon rate annual For.

The present value of perpetual bonds can be calculated with the present value formula of perpetuity.

11 2 Chapter 42 Why Shall We Know The Valuation Of Long Term Securities Make Investment Decisions Determine The Value Of The Firm Ppt Download

What Is A Perpetuity Definition Formula Video Lesson Transcript Study Com

How Bonds Work India Dictionary

Bond Valuation

Perpetual Bonds Define Advantages Disadvantages Calculate Duration

Chapter 4 The Valuation Of Longterm Securities 4

Perpetuity Definition Formula Examples And Guide To Perpetuities

Pv Of Perpetuity Formula With Calculator

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Chapter 10 Bond Prices And Yields Ppt Download

Perpetuity Formula Calculator With Excel Template

Yield To Call Ytc Bond Formula And Calculator Excel Template

Perpetuity Formula Calculator With Excel Template

Impossible Finance The Perpetual Zero Coupon Bond By Martin C W Walker Medium

Bond Yield Formula Calculator Example With Excel Template

Perpetuity Meaning Formula Calculate Pv Of Perpetuity

Present Value Of Perpetuity How To Calculate It Examples